With the advances in technology, businesses are taking the path of digitization. Like most industries, insurance has also developed a mobile application that provides significant advantages to all customers. Insurance mobile applications are easy-to-use apps that streamline internal business processes and promise strong customer relationships. If you are eager to know about insurance mobile app development, we have got you covered. In this article, we will read about insurance mobile apps in detail. We will also shed light on the benefits, features, challenges, and more about insurance apps. So, here we go!

Insurance mobile app development enables insurers to digitize policy management, automate claims processing, and improve customer engagement through secure, scalable mobile solutions designed for modern insurance businesses.

Table of Contents

ToggleWhat Is Insurance Mobile App Development?

Did you know? The global insurance market size is expected to reach $8.4 trillion by 2026 with a CAGR of nine percent yearly. Insurance mobile applications provide users easy access to their insurance services and policies directly from their mobile phones. These applications come with a variety of features, including policy management, claims submission, premium payments, and access to customer support. On these apps, users can keep track of their insurance policy details and claim status in real time. Further, they can receive renewal reminders and notifications about critical updates. The Health Insurance App Development has a secured login feature, ensuring only you can access the data. Additionally, it becomes easier to communicate with the insurance provider at any time and anywhere.

Types of Insurance Mobile Applications for Modern Insurers

Some of the most popular insurance applications are:

1. Policy management apps

The entire process of managing insurance services is automated through the creation of insurance mobile apps for policy management. Underwriting, proposal generation, policy renewal and cancellation, claim processing, and essential compliance checks are a few of them.

2. Insurance quoting apps

Insurance quoting apps streamline the quoting process for all parties involved, speeding up the processes of generating, managing, and distributing estimates. These insurance smartphone apps are built on the premise of quick and precise insurance premium computations.

3. Vehicle insurance apps

The process of on-demand app development for auto insurance includes using smartphone sensors to collect data by monitoring driving habits and behaviour. They give roadside assistance and provide maintenance reminders by keeping an eye on driving behaviour. By creating and providing individualized plans based on data and driving patterns, businesses can have an impact on premium amounts.

4. Home insurance apps

Homeowners can obtain assistance with house insurance-related issues and personalized coverage thanks to home fintech app development. It is simple for customers to add or cancel coverage choices such as flood or earthquake insurance.

5. Travel insurance apps

By enabling policyholders to reduce travel risks and cover sudden, unexpected expenses in situations, travel insurance apps help you generate income. Additional services include insurance against lost or stolen bags, medical emergencies, and travel documents.

DreamSoft4u Since 2003

Get your free quote by the top professionals.

Why Develop An Insurance Mobile Application?

Insurance mobile applications for your business make daily operations and communication with insurance companies and customers easier. Therefore, having insurance Mobile Apps in Healthcare is vital for all businesses. It makes data collection and analysis easier, which improves risk assessment and spurs new product development. It also improves a brand’s competitiveness and visibility in the digital age. All things considered, creating an insurance mobile app is essential to remaining current, effective, and customer-focused in the current insurance market.

Key Benefits of Insurance Mobile App Development for Businesses

1. Improved customer experience

Customers can easily access all data and download documents through the insurance mobile application. Further, they can submit claims easily from their devices. The push notifications feature improved customer experience as it keeps them informed about renewals and the latest updates.

2. Convenient policy management

The insurance mobile app allows users to view policy details efficiently within a few clicks. You can browse through new policies in real-time and update all personal information. Furthermore, these apps make it easier to pay premiums. Additionally, it is helpful for businesses and reduces administrative tasks. Get in touch with experts providing mobile app development services!

3. Streamlining claim processing

The creation of insurance mobile apps provides a hassle-free method for processing claims, saving the company time. It enables them to use that time for other crucial activities, like bringing in new clients. A payment gateway connection is also enabled, so consumers can quickly pay the premium through payment features.

4. Real-time notifications and updates

The insurance mobile apps promote real-time notifications wherein users get updated about their premium payments and policy renewals. Further, they get notifications about discount deals and the next payment due date in real-time. Such apps are also used to accelerate the policy binding and purchasing process.

5. Enhanced communication channels

Through self-service, insurance mobile applications improve the remote and digital communication channels. This is because it eliminates the need to visit an insurance company or indulge in a severe paperwork process. Through personalized policies, customers enjoy round-the-clock support.

Must-Have Features Of An Insurance Mobile Application

1. User registration and login

First and foremost are mobile insurance application user registration and login features. Users can easily log into their accounts by entering their email and phone number and may also accept social media integrations by auto-linking!

2. Policy management

Users can manage their policies, check their information, and peruse all of the policies that are available using this tool. Users must be able to generate a search by entering specified keywords in order for this functionality to function correctly. They can also buy new policies and renew existing ones thanks to this service. Moreover, they ought to get suggested policies based on their past interactions.

3. Claims submissions

Other most popular features of the insurance mobile app are claim filing, tracking, and submitting. Through the insurance mobile app, users can easily file claims and track overall progress. While a developer builds an insurance mobile app, they should develop an easy-to-use application.

4. Premium payments

With payment gateway integration, the premium payments functionality makes it simple for customers to make premium payments. Without payment gateways, an insurance app cannot be fully developed since insurers cannot select their preferred mode of payment. They can also program reminders and instructions for automatic payments.

5. Policy information and documentation

Another most important feature of the insurance mobile application is that the policy’s features are kept safe in a digital format. The storage respiratory includes:

- Old documents

- Current documents

- Prior payments

Using this feature, you can browse different quotations and pick products that suit your interests.

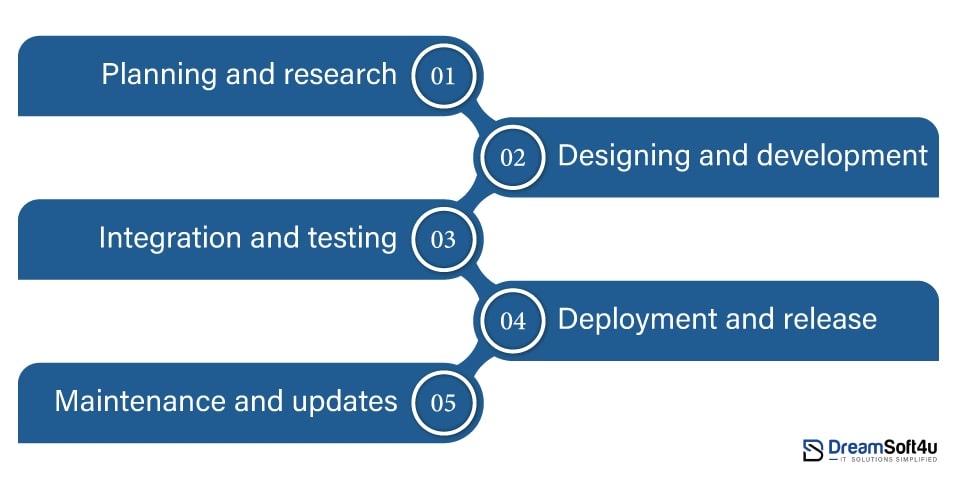

Step-by-step Process To Develop An Insurance Mobile App Development Tools

1. Planning and research

Developing an insurance mobile application includes a lot of planning. The best way to move forward is by building an MVP or minimum viable product. Conduct market analysis, which includes researching the competitor, understanding your target audience, and determining essential features of the app.

2. Designing and development

Gather references that show the designer your preferences and standards. Mood boards simplify UI design and communicate the intended feeling of the product. Organize user engagement with a mind map. Make sure your partner creates a supportable and scalable user interface kit.

This is where the front-end and backend development starts. The back end manages server-side functions, including logic and data administration, whereas the front end focuses on the user interface.

3. Integration and testing

During this phase of the insurance mobile application development process, the UX/UI design is transformed into a mobile app by front and backend programmers. The project manager tracks the advancement of the work and establishes deadlines for completion.

There are deadlines for creating endpoints, integrating backend APIs, and implementing server-side features. Secure backend coding takes a lot of work to ensure the integrity of insurance mobile apps.

4. Deployment and release

In the next step, it is important to ensure that the application is published on different platforms. Feedback from the early application users helps in further updates. Additionally, users provide reviews that act as useful insights for application growth and development. Maintenance, bug patches, codebase oversight, UI/UX tweaks, and compliance with Google and Apple upgrades are all included in the post-release support package. Support varies per month based on your needs.

5. Maintenance and updates

As soon as the product launches on the Google Play Store and the Apple App Store, customer input is collected and analyzed quickly to make quick updates. Increase user engagement as more users equate to more feedback, which improves quality.

Incorporate feedback and concerns regularly to improve the platform and insurance options. After launch, give end-user feedback top priority for incremental enhancements to keep your product fresh and user-focused.

Challenges Faced In Developing Insurance Mobile Application

1. Data protection risks

Data breaches are a serious problem and occasionally render your business bankrupt. They typically occur as a result of improper framework selection, inadequate data encryption, and inconsistent frontend and back-end coding.

2. Increased maintenance and higher downtime

It can be difficult to get higher uptime when back-end infrastructure is poorly chosen. The ideal option is to go with a cloud provider such as Google Cloud Platform, Microsoft Azure, or Amazon Web Services.

3. Insurance fraud

When purchasing insurance coverage offline, insurance fraud is frequently observed. Brokers often give consumers incorrect insurance plans, withhold important information about hidden costs, or both. Everything is clear with the aid of an insurance app. The things that users are looking for can be purchased.

Get Your Customized Mobile Insurance App With Our Experts

We’ve a team of prof developers to deliver you a tailored solution

What Is The Cost Of Insurance Mobile Application Development?

The average cost of building an insurance mobile application is around $200,000. The cost may increase or decrease based on the application features and complexities. Other factors impacting the cost of building an insurance mobile app are:

- Application platform

- App types

- Regulatory requirements

Here is a brief breakdown of the cost of building an insurance mobile application:

| Application complexity | Average time duration | App development cost |

| Simple application | 3 to 6 months | $50,000-$100,000 |

| Medium complex app | 6 to 9 months | $100,000-$150,000 |

| Highly complex app | More than 10 months | $150,000-$300,000 |

How Can DreamSoft4U Help?

DreamSoft4U is a leading software development company offering software development services. It aims to provide tailored solutions to businesses worldwide. It keeps a customer-based approach, providing dedicated solutions that align perfectly with your business needs. With the expertise of more than 100 professionals, DreamSoft4U offers the best solutions. We also provide assistive technology software solutions and more. So, if you want access to the latest tech stack and highly scalable solutions, choose DreamSoft4U now!

Final Words

The insurance landscape is undergoing a significant transformation. Today, insurance businesses are taking the path of insurance mobile app development to streamline operations and offer excellent customer experience. These feature-rich applications allow businesses to connect with users and conduct communication remotely. We hope this mobile app development guide helped you understand deeply. To develop a highly intuitive application, get in touch with experts at DreamSoft4U, a mobile app development company that develops apps with cutting-edge technologies.

Frequently Asked Questions (FAQs)

1. How do you create Mobile Apps for Healthcare?

Here are steps to Developing Mobile Apps for Healthcare:

- Conduct market research and analyze competitors’ market

- Determine all major compliance requirements

- Create an application content and select features

- Design the UI and choose a tech stack

- Build an application

- Conduct tests to mitigate risks

- Launch the application and regular updates

2. List some most popular insurance mobile application

Some popular insurance mobile applications are Singlife App, CoverFox Mobile App- CoverDrive, Mintpro Insurance Business App and Toffee Insurance/Seller App

3. How long does it take to build an insurance app?

On average, it takes around 9 to 12 months to build an insurance mobile application. If you want an app with minimal features, it may take around 4 to 6 months.

4. What factors impact insurance mobile app development?

Some major factors that impact insurance mobile app development include the cost of UI/UX design and front-end development. Other factors affecting are back-end development, and integration of necessary APIs and databases.

5. What tech stack is required for insurance mobile app development?

The tech stack includes:

- Kotlin

- Swift

- React Native

- Flutter (Dart)

- JavaScript

- Xamarin

- Ruby

- Node.js

- Express.Js

- Laravel