With the sudden outbreak of COVID-19, the fear around healthcare increased dramatically. As a result, people started to invest in health insurance. In this digitized world, technology plays an important role. One such innovation of technology is the development of health insurance applications that aim to streamline the insurance process and enhance the overall user experience.

The development of health insurance apps requires in-depth planning, robust security measures, selecting the best features and seamless integration with different apps. Since the demand for health insurance apps is increasing, the market is flooding! In this guide, let us talk about health insurance app development and its benefits. We will also shed light on its features and the entire development process. So, here we go!

Table of Contents

ToggleAn Introduction To The Health Insurance App

In simple terms, a health insurance application is a mobile app that is designed to streamline and simplify your healthcare experience. The market size of health insurance is expected to be valued at US$2.38tn. This is possible due to the digital transformation in healthcare. Individuals can use these applications to insure their health if they meet a medical emergency like an accident, chronic disease and more.

You can easily access your policy details, coverage information, and claims history through the health insurance app. Furthermore, a dedicated health insurance app lets users contact customer services and renew policies. Besides managing your health, these health insurance applications provide valuable resources that keep you informed and healthy.

Types Of Health Insurance Apps

Here are the different types of health insurance applications:

1. Health insurance apps for patients

The health insurance application is a one-stop destination for patients and common people to manage different healthcare and medical insurance requirements. Some common features of health insurance apps for patients include:

- Easy access to coverage information and health insurance plans

- Virtual ID cards are used to simplify access at the time of appointments.

- Claims tracking and submissions

- Provider lookout for finding healthcare providers and specialists.

- Continuous reminders and prescription management

2. Health insurance apps for healthcare providers

Doctors and healthcare professionals also benefit from using different health insurance applications. These applications simplify all administrative tasks like submitting claims and verifying coverage. Further, these allow doctors to focus on overall patient care. Some major features that are a part of the Health Insurance Mobile App for healthcare providers include:

- Verify coverage for services and real-time eligibility checks

- Electronic claims tracking and submissions

- Reminders for follow-up appointments and preventive screenings

- Access to patient’s treatment history and medical records.

3. Health insurance apps for insurance companies

Health insurance companies can influence applications to promote customer satisfaction and overall engagement. Additionally, they boost efficiency in the claim processing. Some major features that are a part of health insurance apps for insurance companies include:

- Plan selection and online enrollment

- Policy documents and digital ID cards

- Track and claim submission

- Video conferencing with doctors for non-emergency conditions

Top Benefits of a Health Insurance App

Here are the top 5 advantages of creating a healthcare app:

1. Minimizing paperwork

No customer wants to collect a million papers and store them in their house, especially when it comes to buying, reviewing, or investing in an insurance policy. That’s when the need for the health insurance app increases. Since these are digitized tools, they eliminate the need for physical documents and papers when proceeding with the policy-buying process. On the health insurance application, the customer can easily perform different tasks without visiting the office.

2. Reducing errors

Back in the day, staff was responsible for managing the customer’s policy documents. Today, customers can easily access information through health insurance apps, all thanks to digital development! Additionally, when tasks like filling out the form and more are performed manually, the chances of errors increase. The most common mistakes are:

- Incorrect name spelling

- Improper email address

- Incorrect policy duration

Besides these, there are several other errors. Since AI-powered applications perform all these tasks, there is no chance of errors.

3. Hassle-free claiming process

Making a claim is a key component of a health insurance policy. No matter how good your customer policy is, it is a total waste if they do not know how to make a claim. On the other hand, users may be able to obtain the necessary information with a specialized app and submit a claim without help. Additionally, it will assist in preventing needless claim denials that arise from inaccurate information or late claim filing.

4. Improved customer engagement

A customer receiving the best assistance and greater convenience will most likely be retained. If your application UI is satisfactory and provides continuous and quick assistance, customers are most likely to stay competent. Customer satisfaction can be evaluated through the user-friendliness of the application. Get in touch with the best Fintech Software Development Services for expert solutions.

5. Continuous communication and support

Health insurance apps are essential to the healthcare ecosystem as they make it easier for consumers and insurance companies to coordinate and communicate. These cutting-edge apps offer different features which improve overall user experience. Customers can easily ask questions and get answers through in-app messaging. Real-time updates on insurance coverage are convenient and guarantee that users are always aware of the specifics of their policy, including any modifications or adjustments.

Most Preferred Software Development Company Since 2003

Request A Free Quote

98% Client Retention

Features of a health insurance app

Here are the top features of a health insurance application:

1. User profile

The first and foremost feature of the health insurance app is the user profile. It allows customers to register themselves on the insurance application. Further, they manage their profiles using their phone numbers, email addresses, policy details, and other important details to complete the information. This feature promotes a personalized user experience for all customers.

2. Policy information

Another important feature of the health insurance app is the policy information, including premiums, deductibles, coverage details, and effective dates. This feature allows users to easily compare insurance plans and make informed decisions based on specific requirements.

3. Payment management

Your health insurance application must be highly adaptable regarding payment options. Develop an application that allows users to quickly sign up and automate invoice processing. Further, it offers incentive calculations and configurable commissions.

4. Media sharing

The media sharing option is quite important in any app related to health insurance. It enables patients to send doctors their prescription records or medical reports for examination easily.

5. Push notifications

Notify your customers with “Push Notifications” during the healthcare app development process if you plan to run special deals or discounts. Updates on claim progress, renewal dates, health advice, exclusive discounts, and other information could be included in the alerts. Adding such features will also assist companies in producing qualified leads.

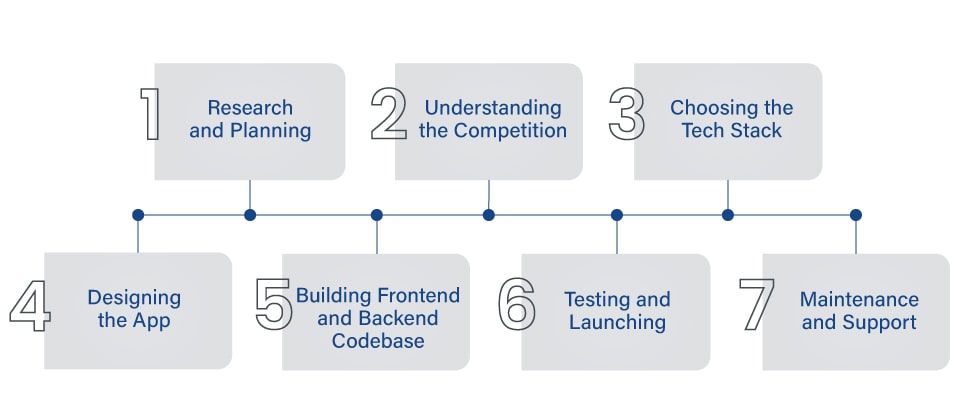

A step-by-step process to build a health insurance app

Here is the step-by-step process performed by the healthcare solution development services provider:

1. Research and planning

The first and most important step in building a health insurance application is conducting in-depth research and planning about the market gap, challenges and potential solutions. Ask yourself questions like:

- What is the purpose of building a health insurance application?

- Why are you building a health insurance app?

Once you find answers to these and similar questions, build a systematic roadmap for a comprehensive and feature-rich application. Once you have a solid reason to build an application, you may easily choose between Android and iOS platforms.

2. Understanding the competition

The health insurance application market is booming like never before. Thus, you must focus on building a highly stable and feature-rich application that stands out in the market! Ensure that your application has all essential features, like your competitor’s apps. Furthermore, they must offer a reliable and interactive experience to all customers.

3. Choosing the tech stack

No matter how much market research you have done or how deeply you understand your competitor’s applications, it all can go to waste if you do not make the right decisions while choosing a tech stack! Keep in mind that picking technologies involves more than just picking a framework for a mobile application. You should also consider programming techniques, libraries, languages, development toolkits, and other things. If you do not have the expertise to choose the best tech stack, rely on an expert health insurance app development company.

4. Designing the app

After choosing the right tech stack for your health insurance app, it is time to focus on the UX and UI of the application. The importance of great UX and UI cannot be underestimated. This is because they attract customers’ attention and keep them engaged with your app. A good application design efficiently conveys your message. Before launching the health insurance application, determine errors through prototyping and eliminate all gaps for a seamless customer experience.

5. Building frontend and backend codebase

Creating codebases is one of the crucial things to think about. Let’s segment into three stages:

Frontend development

This section focuses on building the application’s admin panels and user interface for smartphone products. It recommends using the best front-end development tools including:

- Vue.js

- React.js

- Angular

Backend development

This element concerns the app’s data processing, storage, and security. Even though these are backend operations, they are crucial to improving the program’s functionality. Ensure to consider backend languages like Java, Node.js, and PHP.

Mobile apps in healthcare development

Lastly, it discusses how to create apps and integrate backend endpoints. Kotlin and Swift are great for creating native apps. However, Flutter and React Native are excellent for building cross-platform apps.

6. Testing and launching

The second and most important step in developing a health insurance application is regularly testing it. During this phase, the healthcare app developer hires QA testers to conduct different tests to detect underlying errors before the final deployment. Rigorous testing is important before finally launching the application.

7. Maintenance and support

A successful application needs regular updates and upkeep. Ensure:

Smooth Updates: Provide users with regular updates that let them know about any modifications or new features.

Fixes for bugs: Quickly resolve any bugs or potential technical problems.

Remember the importance of automation in keeping your app up to date.

This complete process is performed by Mobile App Developers to develop a mobile health insurance app that not only meets user requirements but also exceeds their expectations. The ultimate objective is to combine connectivity and ease to create an application that improves and streamlines the health insurance experience.

Examples of health insurance applications

Here are some common examples of health insurance applications:

1. Aetna

Aetna is a leading health insurance application developed by the Aetna Life Insurance Company. It is a popular app that offers users easy access to healthcare experts and allows them to treat different diseases. Additionally, using these applications, users can retrieve their medical information, access medical history, and manage claims. Further, they can communicate with the healthcare experts hassle-free.

2. myCigna

Known for having more than 1 million downloads, myCigna is a popular health insurance application that allows users to track their health expenses and file claims. These applications allow users to easily access individual health and medical data.

3. MyIH

MyIH is another well-known app that made the list! This free health insurance app offers individual and family health insurance services. Users can also communicate with physicians, hospitals, and clinics to receive medical aid.

Cost of building a health insurance app

The average cost of building a health insurance application is around $200,000. The cost may increase or decrease based on the application features and complexities. Other factors impacting the cost of building a health insurance app are:

- Application platform

- mHealth app company location

- App types

- Regulatory requirements

Here is a brief breakdown of the cost of building a health insurance application:

| Application complexity | Average time duration | App development cost |

| Simple application | 3 to 6 months | $50,000-$100,000 |

| Medium complex app | 6 to 9 months | $100,000-$150,000 |

| Highly complex app | More than 10 months | $150,000-$300,000 |

How can DreamSoft4U help?

DreamSoft4U is a leading software development company. It aims to provide tailored solutions to businesses worldwide. It keeps a customer-based approach which means that it provides dedicated solutions that align perfectly with your business needs. With the expertise of more than 100 professionals, DreamSoft4U offers the best solutions. We also provide assistive technology software solutions and more. So, if you want access to the latest tech stack and highly scalable solutions, choose DreamSoft4U now!

Get Your Customized Health Insurance App With Our Experts

We’ve a team of prof developers to deliver you a tailored solution

Wrapping up!

In conclusion, developing the health insurance application requires a tailored approach balancing user experience with compliance and security. When developing the application, prioritize features like intuitive UI, seamless integration and secure data handling. Once the app is developed, it undergoes testing and launching, ultimately delivering user-friendly applications. If you want to develop a highly competitive health insurance application, contact experts at DreamSoft4U!

Frequently Asked Questions

1. Mention a brief process of the health insurance app development process

Here is a brief health insurance app development process:

- Choose the health insurance App Type

- List all Core Features

- Craft UI and UX Design.

- Decide the Development process

- Finalize the Tech Stack

- Look at different Healthcare Compliances

- Develop an MVP

- Testing and launching

- Post-launch care and maintenance

2. What major challenges are experienced during the development of the health insurance app?

Developing a health insurance app isn’t an easy process. Thus, you need experts who can kick-start the development process. During the journey, you come across different challenges, including:

- Data security

- Interoperability

- Regulatory compliance

- HIPAA compliance and security measures

- Integration with wearables

3. List some major factors to consider when hiring a health insurance app development company

If you are hiring a health insurance app development company, you must consider factors like the company’s experience and expertise, tech stack, understanding of the insurance app, and more.

4. How much time does it take to build a competitive health insurance app?

The average time to develop a highly competitive health insurance application is 3 to 6 months. If you want a feature-rich application, the process takes 8-10 months.

5. What factors impact the cost of developing a health insurance app?

Several factors impact the overall cost of developing a health insurance app. These include the application’s complexity, desired features, platform compatibility, tech stack used, integration with existing systems, data security, development team expertise, and location.