In the last decade, Fintech app development has revolutionized the finance industry. Today, the global FinTech market is estimated to increase to $644.6 billion by 2029. This changes how payments are made and received. Some common examples of FinTech applications are Paytm and PayPal which offer notable advantages to customers. Thus, users are switching towards FinTech apps.

Since businesses are becoming aware of FinTech applications, their demand is touching the sky. So, if you are planning to build a FinTech app for your business then keep on reading.

Here we will discuss everything about the fintech app development market, listed top ten fintech app development companies, and things you must consider before building your fintech app. Let’s explore!

Table of Contents

ToggleOverview Of FinTech Apps Development

Financial technology or FinTech, provides financial services using mobile applications. These applications offer users a more accessible and convenient way to manage all finances. Users can operate these applications using smartphones. FinTech app promotes different financial services including online banking, digital payments, investing, and others.

FinTech app development is a dynamic process that uses technology to offer new financial products. The development process includes creating functional and highly intuitive applications that meet growing financial needs.

Further, backend infrastructure is developed and comprehensive testing is done to analyze all bugs. To develop FinTech apps, most businesses prefer hiring professional developers or service providers.

There are various FinTech app development companies available. These companies offer app development services to build an app for fintech businesses with all features. If you’re planning to build a fintech app for your business? You must choose an experienced FinTech app development company to get the best solution.

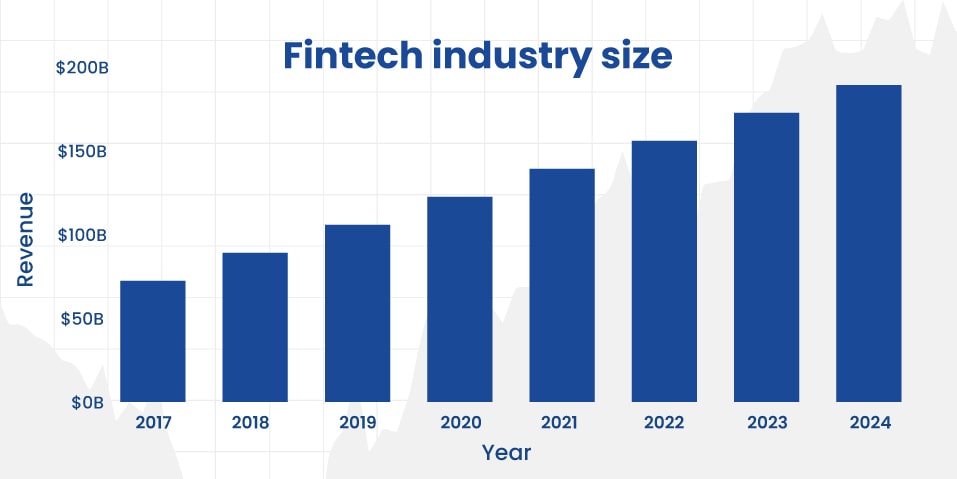

Recent Stats 2024 FinTech App Development

Here are some recent stats that show the Fintech app development market:

- The Global FinTech market is expected to grow from $209.7 billion in 2024 to $644.6 billion by 2029, growing at an average of 25.18% between 2024 to 2029.

- Fintech statistics suggest that the eWallet market will grow to USD 489.3 Billion by 2030.

- There will be more than 26,000 fintech startups around the world in 2024. This number has grown significantly in the past few years.

Top 10 FinTech App Development Companies

1. DreamSoft4U

DreamSoft4U is a leading FinTech app development company. They possess two decades of working experience. Experts at DreamSoft4U use advanced technology to develop seamless digital wallet apps. The company has a team of skilled professionals who use advanced tech stacks, including Net Core, MySQL, Angular, and Xamarin. They work dedicatedly to deliver excellence in all projects. You can surely consider DreamSoft4U for your FinTech app development as they follow a simple 6-step application development process. It starts with conceptualizing and ends with adequate support. With extensive knowledge of e-wallets and 24/7 technical support, DreamSoft4U is the top choice for FinTech app development.

2. Avanade

Avanade has been another leading IT consulting and services provider for the last two decades. They have a team of experienced app developers with intense training and the latest technology access to build robust FinTech apps. You can consider Avande for business-driven custom solutions across various domains, including FinTech. They have worked with 5,000+ global clients and are known for their expertise and promising results.

3. Hedgehog Lab

It is a global tech consultancy specializing in developing smartphone applications. They have a team of highly qualified UXR and UI/UX experts who possess knowledge of Cloud AI & Data Science. Thus, they deliver tailored solutions. Experts at Hedgehog Lab work with partners to design custom applications that meet clients’ needs effectively. Additionally, they build scalable and robust solutions and provide financial data management.

4. DXC Technology

Another company offering iOS App Development services is DXC Technology, headquartered in Virginia, United States. It was founded recently in 2017 and has been contributing to helping businesses globally revolutionize and digitalize as per the industry’s standards. The experts use the latest tech stack to develop effective solutions and provide timely maintenance. Their experts provide support and post-deployment maintenance to upgrade all solutions promptly to stay competitive.

5. Telus International

Known for offering cutting-edge FinTech app solutions, Telus International has had a strong market presence since 2005. Since its inspection, the company has delivered exceptional apps used by FinTech companies and financial organizations. Experts here follow cloud-based and agile methodologies to offer top-notch FinTech applications. The professionals here are known for their customer-centric approach, prioritizing customer satisfaction.

6. SDK.finance

One of the top FinTech app development companies is SDK.finance, which specializes in offering PayTech solutions to the financial industry. Their committed development teams have over a decade of experience in FinTech development. Professionals here swiftly and smoothly realize your financial product idea and suggest tailored solutions. Founded in 2013, the SDK.finance system provides a quick and easy way to construct a variety of payment solutions, such as software for neobanks, digital wallets, currency exchange, and money transfer systems.

7. Appinventiv

Appinventiv is a popular tech firm with over a thousand tech experts. The company is known for developing customer-based and innovative mobile applications. Appinventiv has almost 10 years of experience and a successful track record. You can consider Appinventiv because financial professionals and tech experts work closely together to design custom solutions that offer a competitive business edge.

8. DataArt

DataArt is a famous custom software development engineering company with 20+ years of experience. Its proficiency encompasses digital transformation and modernizing outdated systems, allowing financial institutions to adjust to evolving consumer behavior efficiently. DataArt analyzes the growing FinTech company’s landscape. They address all cybersecurity issues, update the system to meet security standards, and promote great functionality.

9. Day One

Like the other companies on this list, Day One started as a simple concept. Their unwavering passion has helped them rise to the top of the FinTech industry. They are renowned for providing creative, sustainable, and affordable solutions that propel the FinTech expansion. With more than a hundred individuals on staff, most with significant domain experience, Day One offers services across a wide range of FinTech industries. Digital financing platforms, digital insurance platforms, trading and securities, and many more are among them.

10. Azumo

In the FinTech app development sphere, Azumo is an evolving star. They have a team of experienced professionals known for their expertise in mobile solutions and forward-thinking approach to developing user-friendly FinTech apps. Since Azumo builds highly intuitive financial applications and creates a seamless experience that resonates with today’s users, we picked it up on our list.

Five Types Of FinTech Apps

There are different types of FinTech apps available in the market:

1. Insurance Application

Designed to buy and sell insurance policies online, the insurance application is a popular FinTech app offering different benefits and features. These include claim processing, policy management, and emergency assistance. Such applications are known for their easy processing, reliability, and quick service.

2. Cryptocurrency and Blockchain Application

This application promotes investments and transactions within cryptocurrencies such as Ethereum, bitcoin, and other digital assets. Such applications have features like trading, storing, and managing crypto holdings. Common examples of cryptocurrency and blockchain apps are Binance, Coinbase, and Blockchain.info.

3. Money Lending Application

This application bridges the gap between people who want to borrow money and lenders. You may get different types of loans on these apps. Commonly given loans are business, car, personal, and mortgage loans.

4. Investment Applications

Using these applications, you can buy ETFs and other financial instruments with a few clicks. They often offer features like automated investing, portfolio management, and educational resources. These applications have made investments easier than ever before.

5. Personal Finance Applications

Like budgeting applications, personal finance apps offer customers a bigger picture of their overall spending spending and earnings in a week, month, and annually. Some common types of personal finance apps are investment, credit score, expense tracking, budgeting, and more.

Some Must-have Features Of A FinTech Application

These are some key features that every FinTech app must have:

1. Security

Safety and security are an integral part of the finance industry. Since your FinTech app stores individuals’ personal and financial information, it is essential to meet all security standards during AI app development. Thus, ask your developer to rely on high-level security practices. Additionally, they must implement techstack, including blockchain, biometrics, encryption, two-factor authentication, data obfuscation, and others.

2. Payment Gateway Integration

Sending and collecting payments are two of the primary functions of a FinTech application. Thus, implement robust payment gateway integration for smooth operations. Your FinTech app developer can rely on payment gateway integrations like PayPal, Stripe, etc.

3. Dashboard

Finance management becomes more accessible through FinTech applications. It is best to offer the dashboard feature within the FinTech application, displaying the user’s spending, earnings, stock charges, and payment history. This makes it easier for them to understand their spending patterns and make plans for better decisions in the future.

4. Voice Integration

Another most important feature of the FinTech app is the voice integration. With the introduction of Alexa, chatbots, and voice assistants, people remain excited about voice assistant services. Through the voice integration feature, you can connect with the app without actually opening it.

5. Real-time Notifications

Your FinTech application must inform users about different financial activities through notifications. These include bill due dates, account balances, potential fraudulent transactions, usual spending patterns, and others. The application should have a customizable notification feature to keep the user informed throughout.

Top Ways to Monetize Your FinTech App

1. Subscriptions

Subscriptions are the most familiar way for anyone who has ever used any type of mobile application or online service. Most applications provide a trial period that lasts from a few days to a week. This allows you to explore different features. Once the subscription expires, the user will likely invest and choose a monthly or yearly subscription.

2. Transactional Fee

Payment systems and mobile payment applications mostly use the transactional fee model. Here, the fee is applied to either specific or all payment options. Common examples of cash exchange services include WorldRemit and Payoneer. This model is mostly used as an addition to the subscription model.

3. Ads And Referrals

Highly targeted advertisements and recommendations from relevant advertisers can form the foundation of your FinTech monetization plan if you have a strong customer base. Although using your services is free, users will receive highly targeted advertising offers.

Benefits of Hiring a FinTech App Development Company

1. Expertise in Financial Technology

Fintech app development companies specialize in designing secure and innovative solutions tailored to the growing needs of the financial industry. The company deeply understands fintech applications for payments, lending, banking, and other financial services. They follow the industry’s best practices and meet security standards.

2. Time and Cost Efficiency

Developing a fintech application all by yourself is a time and cost-consuming task. Meanwhile, when you partner with a Fintech app development company, you save time and resources. These companies have professional experts who collaborate to deliver the best solutions in the given timeframe.

3. Proven Track Record

Since fintech app development companies have experts with a proven track record of past work, you get access to the best services. When you hire professionals from wearable app development companies, you will get high-quality results.

4. Scalability and Flexibility

Another major benefit of hiring a FinTech app development company is they design scalable and highly flexible solutions. This allows businesses to adapt and grow with the changing market environment. This scalability ensures your application performs optimally as the business grows.

5. Support and Maintenance

The Fintech app development company provides round-the-clock support and maintenance once the iPhone app development company is built and launched. The experts regularly update the application and add necessary features. In case of any glitches, the app undergoes maintenance.

Factors To Consider When Choosing the Best FinTech App Development Company

1. Experience

While choosing the FinTech app development company, prioritize the developer’s experience. Choose a company that uses an updated tech stack. It includes machine learning, artificial intelligence, and blockchain. Also, the developers must have years of experience in developing FinTech apps.

2. Track Record Of Success

Partnering with a FinTech app development company with a robust track record has proven beneficial. Before hiring, check the ratings and reviews on Google to ensure they can meet your expectations. Also, deeply study their past work and get an idea of their success rate.

3. Risk Mitigation Plan

Analyzing and managing risk are major tasks for a FinTech app development company. An ideal company has a risk management plan and tool wherein all risks are analyzed and effective solutions are implemented.

4. Security Measures

Proper security and safety are important when discussing FinTech applications as they affect your finances. Thus, choose a company that implements robust security channels. Things such as intrusion detection and firewalls are common requirements for FinTech app companies.

5. Portfolio

Before hiring a FinTech app development company, closely review their portfolio and case study to analyze the company’s capabilities and expertise. Look at a diverse portfolio featuring different financial applications. This ensures that the company is capable of handling your particular niche.

Want to Build a Fully-Featured FinTech App For Your Business?

Out Experts Can help turn your vision into reality

How Can DreamSoft4u Help You Build A FinTech App?

Dreamsoft4u is a leading app development company. It is known to offer highly scalable solutions. With 20 years of experience, Dreamsoft4u has a team of over a hundred skilled professionals in finance and accounting app development. These experts develop Paytm-like applications, making transactions easier and safer than ever before. To get the best FinTech app solutions, contact us today!

Wrapping Up!

FinTech applications have come to the center stage as the world takes the path of digitization. Today, most people rely on these apps to make and collect payments. The most common examples of FinTech applications are Paytm and PayPal money. As the popularity of fintech is increasing in the global market, the demand for fintech apps is rising. If you plan to build your FinTech application, these top ten development companies offer the best solutions. Out of the list, Dreamsoft4u is the most popular one, providing the best services.

FAQs

Q.1 Should I outsource or hire an in-house FinTech app development team?

Choosing between the two completely depends on your app requirements. Before choosing, remember that an in-house team keeps you in the loop throughout development.

Q.2 Mention the FinTech app building cost

Building a FinTech application costs between $60,000 and 120,000. An application with a basic feature ranges between $30,000 to 60,000.

Q3. What challenges does a FinTech app development company experience?

Some major challenges that the FinTech mobile app development firm experiences are data security, lack of technical expertise, regulatory compliance, blockchain integration, and others.

Q4. What is the future of Fintech applications?

Contactless payments and digital wallets are the most popular trends as the world moves towards the cashless era. In the next decade, FinTech app users will experience more secure and convenient payment options.

Q5. What factors impact the cost of FinTech app development?

Major factors impacting the cost of FinTech applications are types of apps, complexities, services offered, time, platform, and security services.