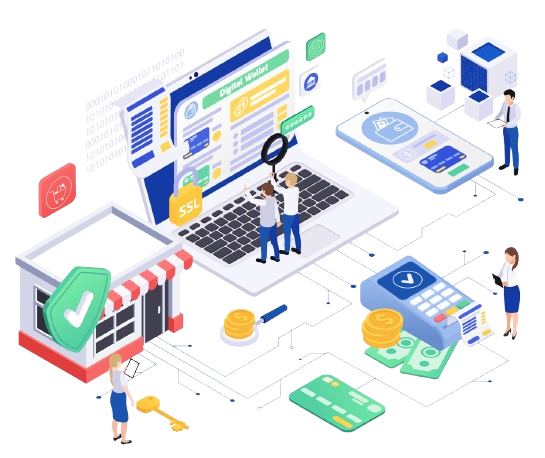

Fintech Software Development Solutions for Modern Finance

The users tap and make transactions, trade, manage finance, and use e-wallets through the modern fintech software and apps. Our finance services and solutions are designed for performance, compliance, and scalability.

Mobile Banking App Development

We build secure mobile banking apps where users can manage accounts, transfer funds, and track expenses at one platform. It also updates users with real-time notifications and complete transaction transparency.

Digital Wallet and Payment Gateway Development

Our developers specialize in building eWallets following PCI DSS compliance. Moreover, we built multi-currency payment gateways as well, with promising encryption and error-free transactions. This software is integrated with modern tech for prevention, predictions, and real-time analytics.

Investment and Stock Trading App Development

Intelligent trading and investment app development where users will get live market data, portfolio tracking, and actionable insights to help users make smart transactional decisions.

P2P Lending App Development

Peer-to-peer lending and loan software development for users, which has features like credit scoring, EMI tracking, borrower-lender matching, regulatory compliance, e-payment processing, etc. There is 100% transparency between users and money management.

Mobile Point-of-Sale (mPOS) System Development

Our mPOS software helps businesses to accept digital payments. This solution is integrated with features like invoicing, inventory tracking, and real-time analytics that help in making accurate decisions and improving efficiency in operations.

KYC Platform Development

We prepare automated KYC platforms which does customer verification using AI, OCR, and biometric authentication. It maintains compliance with AML, GDPR, and global financial regulations to make it an authorized platform.

Insurance App Development

We develop InsurTech apps that help financial institutions to do policy management, claims automation, and premium tracking. It enhances user experience, reduces paperwork, and supports end-to-end digital insurance workflows.

Finance Management App Development

We are helping users to do money management with financial management software. These solutions have features like budgeting tools, spending analytics, goal tracking, and AI-driven insights, which help users plan their budgeting and grow their financial portfolios.

Finance Fraud Detection Software

Financial fraud detection software is capable of monitoring every transaction, anonymous accesses, and identifying anomalies that protect your accounts and finances from unauthorized activities. This software has modern techs integrated, such as predictive analytics and rule-based risk models, through which frauds are identified.

FinTech Development Services We Offer

We deliver full-cycle fintech software development services that help users and financial institutions to design, automate, and secure the digital finance environment.

Fintech Consultancy

We provide fintech development consultancy services, where we redefine the market needs, precisely select technology, architecture planning, and compliance mapping to build an app or software 100% compliance-friendly, perfect to run based on current market standards.

UI/UX Design Services

Our fintech software and mobile applications are designed with intuitive interfaces where users will experience smooth navigation, regulatory-compliant layouts, and accessibility-driven workflows to drive exceptional experience and build trust.

Custom Fintech App Development

There is no fixed layout, framework, or tech for our Fintech app development services. During the consultancy, we define the uses and business goals to customize the finance app based on the needs. Also, add the APIs tailored to the operational and compliance requirements.

Custom Fintech Software Development

Our developers are experienced enough to do Custom fintech software development, where the features, technologies, analytics, automation, and architecture – everything is integrated into the software based on the product needs and global standards.

API Integration Services

For full-fledged finance app development, we integrate third-party APIs like banking, payment, and financial APIs for effortless data exchange, real-time updates, and improved system interoperability across all sectors of the finance industry.

Legacy System Modernization

There is no need to develop new software. DreamSoft4u also offers legacy system modernization services, where we will integrate the new-market features, compliance, and modern technologies into the existing ones to improve performance and agility.

Quality Assurance & Testing

After the finance software development, we do testing and quality assurance of the application to learn if there are any bugs, technical glitches, or functionality errors happening or not. We follow the QA process, following all the manual and automated testing standards.

Support & Maintenance Services

Besides the development and deployment, we provide support and maintenance services after the product or service market launch. Here, our dedicated developers will monitor the performance, check for version upgrades, and maintain your fintech solution, friendly with the current requirements to scale.

Key Features of Our Fintech Software

Our fintech software is built with cutting-edge technologies and industry best practices to ensure high performance and data security, enabling businesses to operate with agility.

- 1.Bank-Grade Security

- 2.AI-Powered Automation

- 3.Cloud-Native Architecture

- 4.API-Driven Ecosystem

- 5.Real-Time Data Processing

- 6.Customizable Modules

- 7.Global Compliance Ready

- 7.Cross-Platform Accessibility

Highly secure encryption, multi-factor authentication, and secure APIs provide both data confidentiality and compliance with applicable laws for every transaction in the Fintech space.

Intelligent workflows and predictive analytics increase decision-making effectiveness, fraud detection, and operational efficiencies across all Fintech platforms.

Deploy applications that are highly scalable and resilient in the cloud infrastructure designed for uptime, speed, and cost.

Seamless connections into banking systems, payment gateways, and third-party Fintech apps improve operations to real-time.

Instant analytics and reporting provide data to support critical financial decisions, transaction monitoring, and performance.

The modular architecture allows the business to scale and modify or upgrade functionality as business needs change.

A PCI DSS, GDPR, KYC, and AML standard-ready solution across multiple regions.

Fintech applications are optimized for mobile, web, and desktop devices to ensure a smooth and consistent experience.

Modern Technologies That Power Our Fintech Applications

We are backed by modern technologies in our Fintech mobile apps to drive agility, intelligence, and high-end security into the systems. DreamSoft4u will make such finance software and mobile applications that are compatible with next-gen technologies.

Artificial Intelligence & Machine Learning

The implementation of AI and ML in finance software will help in bringing automation, performing predictive analysis, and identifying fraud in real-time. It helps in optimizing the operation, preventing anomalies, and personalizing the experience.

Blockchain Integration

Blockchain in finance will establish transparency and tamper-proof financial systems. It also ensures traceability, trust, and fast transaction clearance through smart contracts and cross-border settlements.

Cloud Computing

Our cloud-native architecture enables scalability, agility, and cost control. With automated DevOps pipelines, we ensure faster deployment, zero downtime, and continuous delivery across fintech environments.

Microservices Architecture

We use secure APIs and microservices to build connected ecosystems where banking, lending, and payment systems communicate seamlessly. It has interoperability and modular scalability to

Big Data Analytics

Leverage real-time analytics for portfolio risk, user behavior, and fraud detection. Our data engineering frameworks transform raw financial data into actionable business insights.

Robotic Process Automation (RPA)

We use RPA to simplify repetitive financial operations — such as data entry, compliance checks, and transaction reconciliation — improving accuracy and reducing manual overhead.

Cybersecurity Frameworks

With multi-layered encryption, tokenization, and continuous monitoring, our systems ensure financial-grade data protection aligned with PCI DSS, GDPR, and ISO 27001 standards.

Internet of Things (IoT) in Finance

IoT devices integrated into fintech systems enable connected payments, asset tracking, and real-time data collection, helping businesses improve financial visibility and customer engagement.

Industries & Use Cases

Our skilled fintech developers partner with businesses across sectors to simplify financial operations, strengthen trust, and open new growth opportunities through technology.

Why DreamSoft4u For Fintech App Development?

With over a decade of expertise in financial technology, DreamSoft4u helps businesses modernize, scale, and secure their financial operations with precision-engineered fintech solutions built for long-term impact.

-

Strategic Approach of Development

Our fintech consultation and development services ensure decisions deliver measurable ROI and long-term market differentiation.

-

Prompt Project Deliveries

Our agile delivery model emphasizes milestone-based accountability, transparent progress, and real-time visibility to eliminate uncertainty.

-

Measurable Business Outcomes

From reduced operational costs to improved transaction efficiency, we focus on tangible success metrics that matter to your boardroom and bottom line — not vanity indicators.

-

Modern Tech-Driven

Our expert fintech software developers combine technical depth with strategic insight to help CXOs make informed, future-ready technology investments.

-

Innovation In Solutions

We develop Fintech solutions that solve real financial challenges, improve decision-making, and open new revenue streams across digital ecosystems.

-

Support to Optimize

We offer proactive consultation, market insights, and continuous optimization to keep your business ahead of emerging financial technologies.